Update - June 10, 2024:

With the successful completion of the Casera and Carpathia merger, we want to thank everyone for their patience as we completed this important milestone for our organization.

We are now in a position where we can streamline our operations to ensure a consistent experience for all members, in any community, and across any channel. Our priorities continue to be serving our members with excellence, investing in our communities for a sustainable future, and empowering our staff to reach their full potential.

As we complete our operational alignment between Casera Credit Union, Carpathia Credit Union, and Access Credit Union, we are excited to inform our members that our database integration will take place over the weekend of June 7 - 10, 2024.

A weekend integration is scheduled to reduce the impact on members’ day-to-day transactions. We’re working hard to minimize inconvenience to our members. However, there will be some impacts to you during integration weekend.

Prepare for the new Access digital experience Monday, June 10, 2024

With this integration, we will be upgrading your digital experience to a new platform. Are you an Ideal Savings member? Click here

Please see below for important information regarding how to prepare for and key dates to keep in mind.

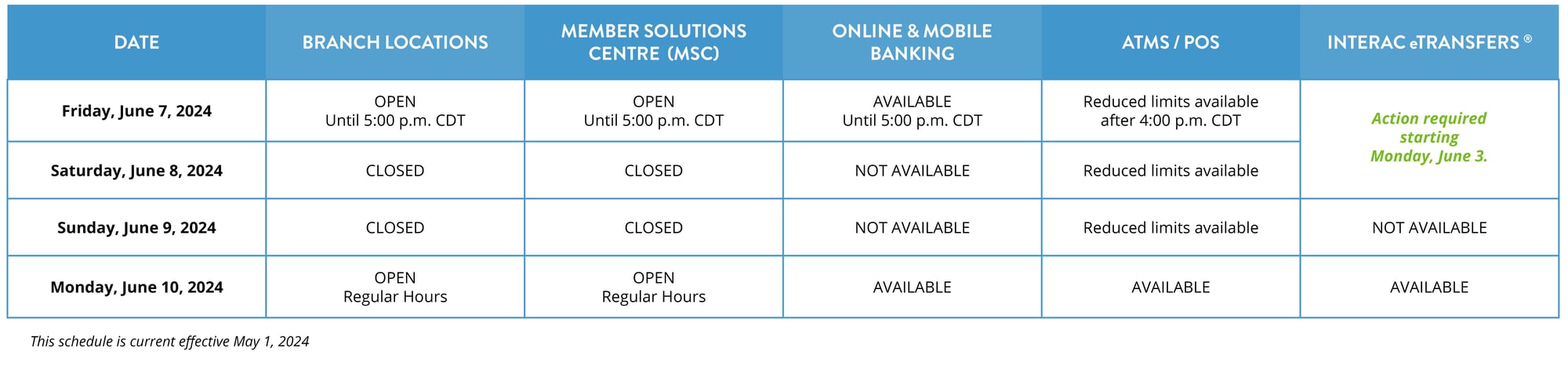

Service disruptions:

* For complete branch hours, please visit: https://www.accesscu.ca/en/contact

What you need to know about integration weekend

To align our systems, we will be completing our system integration from Friday, June 7 – Monday, June 10. During this time, members will lose access to online and mobile banking. It is recommended to complete all urgent online banking transactions prior to Friday, June 7.

How can you prepare for the integration weekend?

Interac e-Transfers® will be impacted starting Monday, June 3.

Please review the outage schedule below to prepare for this service interruption. Full access to Interac e-Transfers will be restored once you have onboarded to the new online banking experience, on or after Monday, June 10, 2024.

Before Monday, June 3:

Send Money:

- Send any planned e-Transfers.

- Advise your recipients to accept any pending e-Transfers.

- Cancel any pending e-Transfers that have not been accepted by your recipients.

Before Wednesday, June 5:

Recipient List & History:

Take note of e-Transfer history and recipient list, including email/phone numbers. These features will not carry forward to the new online banking experience.

Accept Money:

- Check email and text notifications and action pending e-Transfers accordingly.

Request Money:

- Fulfill any Request Money® transactions.

ATM & POS Transactions

ATM and POS transactions will be limited. Please take out cash or use credit cards during the integration weekend. If you are withdrawing cash, please do so before Friday, June 7 (or be prepared to use an alternative method of payment for purchases June 7-10).

Online & Mobile Banking

Online and mobile banking will be unavailable during integration activities. Please complete any urgent transactions before

5:00 p.m. CDT on Friday, June 7.

Member Services

Branches and our Member Solutions Centre will be closed from Friday, June 7 at 5:00 p.m. until Monday, June 10, returning to regular business hours. Please complete any urgent transactions early in the day on Friday, June 7 to avoid delays.

Other features that require action:

Me2Me Transfers

- Complete any Me2Me transfers before Wednesday, June 5.

- The Me2Me function is not available on the new online banking experience.

Transfer Frequencies

- For members who currently use semi-annual or semi-monthly transfer frequencies, these transfer dates/details will be missing in online banking; however the transactions will continue to process.

Business member impacts

- Pending two-signor transactions will not carry over after integration weekend. Please action these transactions prior to June 7, 2024.

- Corporate Capture will not work over integration weekend.

- Delegate(s) logins will need to be set up after integration.

- CRA future dated payments will not carry over after integration weekend. Please delete any CRA payments due after June 7, 2024.

- Business CRA bill payees and payments will not carry over after integration weekend. Please make note of your CRA bill payee details before June 7, 2024.

What you need to know (and do) after integration weekend

What will not change after integration?

- Account Nicknames named prior to conversion will carry the nickname forward into the new system.

- Existing ATM/Debit Cards will remain active and valid. PINs will remain the same.

- Automatic Transfers such as pre-authorized payment and direct deposits, will carry over to the new system. This includes bill payments, payroll deposits (excludes CRA Payments), and automatic loan payments.

- Bill payees (excluding business CRA) and future dated bill payments (excluding personal & business CRA) set up prior to June 7th.

- Cheques will continue to clear as expected.

- Stop Payments put in place prior to conversion will remain after conversion weekend.

What do members need to know and/or do after integration?

After integration weekend, Carpathia members will sign into online banking from the accesscu.ca website or download the Access CU mobile app.

Onboarding

After integration, Carpathia members can onboard via the Access CU mobile app or via the accesscu.ca website:

- Go to accesscu.ca and click 'Sign In' or download the mobile app.

- Onboard to Access’ online banking using your Carpathia debit card or the online banking temporary login code mailed to you in May 2024.*

*Only members without a debit card and active online banking will receive this temporary login.

- To verify identity, enter date of birth and mobile phone number or email address that we have on file. You will receive a verification code on your phone or email. Enter the code.

Note: Business members will use their personal cell phone or email address for verification when onboarding.

- Choose a username and password.

You will need to validate against date of birth and cell/email on file and will be prompted to create a strong password (PAC) after One Time Passcode (OTP) validation*.

| Alphanumeric: Can include: Upper case, lower case, numbers, and certain special characters (dash -, underscore _) |

| Between 4 and 35 characters |

| Cannot use the debit card number |

| Cannot use an email address |

| Must be unique (does not already exist for another user) |

| Cannot contain profanity |

Remember - You cannot change your username once selected!

|

| *Select your area code in the first box, and then enter the rest of the 10 digits in the next box. If you add +1 XXX XXX XXXX in the cell box, you will get an invalid phone number error and not receive your One Time Passcode (OTP). |

- Click 'Create User Profile' to finish.

The next time you login, simply use the username and password created.

You can set up biometrics once you have logged in for the first time.

Please visit accesscu.ca/digital for tutorials, tips and tricks, and a full list of features and benefits.

Note: If you already use online banking as an Access CU or Hubert member, you will continue to sign in as normal with those credentials and your Carpathia accounts (where applicable) will be viewable on that login when service returns.

MOBILE BANKING

After integration weekend, Carpathia members will need to download the Access mobile app.

Features to explore

- Enroll in Autodeposit

-

- Autodeposit settings are deactivated during integration. If you use this feature, please re-enroll before trying to accept your first e-Transfer.

- If you wish to manually deposit e-Transfers, Select Manitoba for Province, and select Access Credit Union under the Credit Union dropdown.

- e-Transfer recipients

-

- Add your contacts back to your e-Transfer profile.

- Set security Alerts to your preference

-

- Note – SMS messages will come the number 22377 and emails from (notifications@alerts.accesscu.ca)

- Add your debit card to your mobile wallet

-

- Please note that even if you have a Carpathia-branded card, you’ll need to select the Access card in the mobile wallet app.

- Set up and/or make a payment, if required, to your personal CRA account

-

-

Future Dated Payments (one time and recurring) will not carry forward to the new online banking experience.

-

What’s different?

- No limit when depositing cheques using Mobile Capture

- You can now make principle only payments to loans and mortgages

- You can now open subsequent chequing and savings accounts from online banking

- If you have an existing registered plan, you can open select registered term deposits

- Update your contact details directly from online banking

Business Members

- You may be able to view accounts that require two signors, however you will not be able to complete any transactions on online banking unless you have two signors available.

If you receive the below message, you are attempting to transact on a dual signor account:

“The transaction was not completed. Kindly reach out to your credit union branch to complete this transaction.”

- Delegate(s) logins will need to be set up again.

- Consolidate your business profiles to your preference.

- Reset any business CRA Future-Dated Payments.

- Re-add CRA bill payees and payments.

- Enroll to MyCRA to view tax documents.

The new online and mobile banking service also offers several new features and security benefits, allowing you make the most of your business online banking account:

- Online dual signature access for businesses with dual-signing authority

- Increased Interac® e-Transfer send limits

- Ability to consolidate accounts once your business is set up online

- Higher Mobile Capture limits when depositing cheques via mobile app

For more information, please visit: https://www.accesscu.ca/en/business/convenience/digital-banking

Statements

Access Credit Union uses a ‘relational statement’ model. This means the information presented on your one statement is inclusive and personalized to you, the member, and therefore, based on accounts in which you have an ownership role, including any joint accounts you may be a part of.

Statement Cycles

Your final Carpathia statement will be dated May 31 (regardless of your current statement cycle option).

After the integration, you will receive your statement on a month-end cycle. The first Access branded statement will be for June 1 – 30 (delivered in July).

Statement delivery options

If you currently use online banking, and have at least one statement set to view via ‘e-Statement Only’, all of your statements will be delivered via e-Statement only. No statements will be printed and mailed. If you require paper statements, please visit a Carpathia branch to set your statement preferences.

You will have access to historical statements up to and including September 2019 on online banking.

- If you require historical statements from the period between June 2017 to August 2019, please visit your local branch.

If you currently receive printed statements and do not have access to online banking, your statements will continue to be mailed as they are today.

Click here for more information on statements.

Business statements

Businesses and Organizations: where the Tax Reported Owner is a business or organization, all accounts will display on one statement even if accounts have different signers assigned. This also means that all signers of the business or organization who have online access will be able to view the e-statements which include accounts they are not signers on.

Sole Proprietorships: as defined by CRA, a sole proprietorship is a business that has not been registered independent from the owner. Under this membership structure all accounts, both business and personal, are owned by the individual. This means that your statement will also consolidate all business and personal accounts.