Update - June 10, 2024:

With the successful completion of the Casera and Carpathia merger, we want to thank everyone for their patience as we completed this important milestone for our organization.

We are now in a position where we can streamline our operations to ensure a consistent experience for all members, in any community, and across any channel. Our priorities continue to be serving our members with excellence, investing in our communities for a sustainable future, and empowering our staff to reach their full potential.

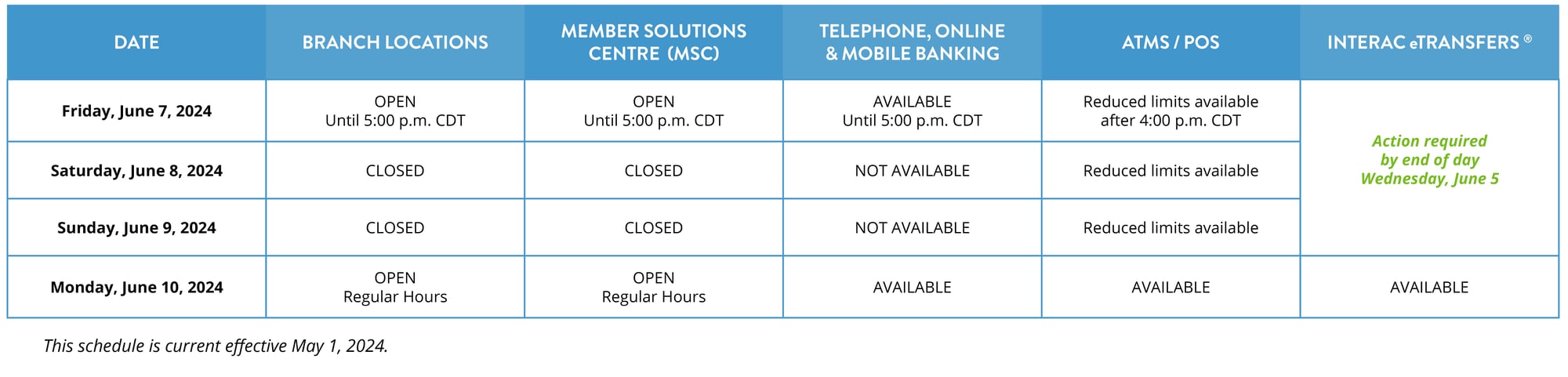

As we complete our operational alignment between Casera Credit Union, Carpathia Credit Union, and Access Credit Union, we are excited to inform our members that our database integration will take place over the weekend of June 7 - 10, 2024.

A weekend integration is intended to reduce the impact on members’ day-to-day banking transactions. We’re working hard to minimize inconvenience to our members, however, there will be some impacts on members during this integration weekend.

Please see below for important information regarding how to prepare for integration weekend and key dates to keep in mind.

Service disruptions:

What you need to know about integration weekend

To align our systems, we will complete our system integration from Friday, June 7 – Monday, June 10. During this time, members will lose access to online and mobile banking. It is recommended to complete all urgent online banking transactions before Friday, June 7.

How can you prepare for the integration weekend?

Interac e-Transfers®

By end of day Wednesday, June 5:

- Send any planned e-Transfers

- Inform your recipients to accept pending e-Transfers

- Accept any pending e-Transfers

- Fulfill any Request Money® transactions

- Take note of e-Transfer history and recipient list, including email/phone numbers. These features will not carry forward to the new online banking experience.

ATM & POS Transactions

ATM and POS transactions will be limited. Please take out cash or use credit cards during the integration weekend. If you are withdrawing cash, please do so before Friday, June 7 (or be prepared to use an alternative method of payment for purchases June 7-10).

Online & Mobile Banking

Online, mobile and telephone banking will be unavailable during integration activities. Please complete any urgent transactions before 5:00 p.m. CDT on Friday, June 7.

Branch & Member Solutions Centre

Branches and our Member Solutions Centre will be closed from Friday, June 7 at 5:00 p.m. until Monday, June 10, returning to regular business hours.

Please complete any urgent transactions early in the day on Friday, June 7 to avoid delays.

Business members

- Pending two signor transactions will not carry over after integration weekend. Please complete before June 7, 2024.

- Corporate Capture will not work over the integration weekend.

- Existing business CRA Payees will not carry over after integration weekend. Note the details to set up after the integration.

- Existing business CRA Future-Dated Payments will not carry over after integration weekend. Note the details to set up after the integration.

What you need to know (and do) after integration weekend

What will not change after integration?

- Account Nicknames named prior to conversion will carry the nickname forward into the new system.

- Existing ATM/Debit Cards will remain active and valid. PINs will remain the same.

- Automatic Transfers such as pre-authorized payments and direct deposits, will carry over to the new system. This includes bill payments, payroll deposits and automatic loan payments.

- Bill Payees and future dated payments set up pre-integration will remain (excludes CRA payments).

- Stop Payments put in place prior to conversion will remain after conversion weekend.

What do members need to know and/or do after integration?

-

After integration weekend, Casera members will sign into online banking from the accesscu.ca website or download the Access CU mobile app.

TIP: Please delete the old Casera app to avoid confusion.

Onboard to the Access online experience

Note: If you already use online banking as an Access or Hubert member, you will continue to sign in as normal with those credentials and your applicable Casera accounts will be viewable on that login when service returns.

After integration, members must onboard to the Access CU mobile app or the accesscu.ca website. The steps are as follows:

- Go to accesscu.ca and click 'Sign In' or open the mobile app.

- Enter your 19-digit Casera debit card number, or the online banking temporary login code mailed to you in May 2024.*

*Only members without a debit card and active online banking will receive this temporary login

- To verify identity, enter date of birth and mobile phone number or email address that we have on file. You will receive a verification code on your phone or email. Enter the code.

Note: Business members will use their personal cell phone or email address for verification when onboarding.

- Choose a username and password.

Remember - You cannot change your username once selected!

- You will need to validate against date of birth and cell/email on file and will be prompted to create a strong password (PAC) after One Time Passcode (OTP) validation.

| Alphanumeric: Can include: Upper case, lower case, numbers, and certain special characters (dash -, underscore _) |

| Between 4 and 35 characters |

| Cannot use the debit card number |

| Cannot use an email address |

| Must be unique (does not already exist for another user and cannot be your previous Casera username) |

| Cannot contain profanity |

- Click 'Create User Profile' to finish.

|

| Select your area code in the first box, and then enter the rest of the 10 digits in the next box. If you add +1 XXX XXX XXXX in the cell box, you will get an invalid phone number error and not receive your One Time Passcode (OTP). |

The next time you login, simply use the username and password created. You can set up biometrics once you have logged in for the first time.

Please visit accesscu.ca/digital for tutorials, tips and tricks, and a full list of features and benefits.

Features To explore

- Enroll in Autodeposit

- e-Transfer recipients

- Set security Alerts to your preference

- Note – SMS messages will come the number 22377 and emails from (notifications@alerts.accesscu.ca)

- Add your debit card to your mobile wallet

- Set up and/or make a payment, if required, to your personal CRA account

What’s different?

- No limit when depositing cheques using Mobile Capture

- You can now make principle only payments to loans and mortgages

- You can now open subsequent chequing and savings accounts from online banking

- If you have an existing registered plan, you can open select registered term deposits

- Update your contact details directly from online banking

Other impacts you need to know

- Foreign Funds Calculator is no longer available.

Business members

- You may be able to view accounts that require two signors, however you will not be able to complete any transactions on online banking unless you have two signors available.

If you receive the below message, you are attempting to transact on a dual signor account:

“The transaction was not completed. Kindly reach out to your credit union branch to complete this transaction.”

- Delegate(s) logins will need to be set up again.

- Consolidate your business profiles to your preference.

- Set up your business CRA Payee(s).

- Reset any business CRA future-dated bill payments.

The new online and mobile banking service offers several new features and security benefits, allowing you make the most of your business online banking account:

- Increased e-Transfer send limits

- Higher Mobile Capture limits when depositing cheques via mobile app

For more information, please visit: https://www.accesscu.ca/en/business/convenience/digital-banking

Statements

Access Credit Union uses a ‘relational statement’ model. This means the information presented on your one statement is inclusive and personalized to you, the member, and therefore, based on accounts in which you have an ownership role, including any joint accounts you may be a part of.

Statement Cycles

Your final Casera statement will be dated May 31 (regardless of your current statement cycle option).

After the integration, you will receive your statement on a month-end cycle. The first Access branded statement will be for June 1 – 30 (delivered in July).

Statement delivery options

The option to change statement delivery options from online banking will not be available post-integration.

If you currently use online banking, and have at least one statement set to view via ‘e-Statement Only’, all of your statements will be delivered via e-Statement only. No statements will be printed and mailed. If you require paper statements, please visit a Casera branch to set your statement preferences.

You will have 7 years of historical e-statements loaded onto the Access online banking platform (although this may not be immediately viewable after integration).

If all statements are set to ‘receive a printed statement’ and you do not have access to online banking, statements will continue to be mailed as they are today.

Click here for more information on statements.

Business statements

Businesses and Organizations: where the Tax Reported Owner is a business or organization, all accounts will display on one statement even if accounts have different signers assigned. This also means that all signers of the business or organization who have online access will be able to view the e-statements which include accounts they are not signers on.

Sole Proprietorships: as defined by CRA, a sole proprietorship is a business that has not been registered independent from the owner. Under this membership structure all accounts, both business and personal, are owned by the individual. This means that your statement will also consolidate all business and personal accounts.

Telephone Banking

Following integration, members will access telephone banking by calling 204.949.1048 (Winnipeg) or toll-free at 1.877.835.7378.

- Log in with your member number and your password, which has been temporarily reset to the last four digits of your SIN.

- We encourage you to change your temporary password after your first login.

- The telephone banking menu will change, please listen to all menu options carefully.

Cheques

Casera cheques will continue to clear as normal.

If you receive a letter that your account number is changing, we encourage you to order new cheques otherwise, you will not be able to view them on your transaction history nor will you see cheque images in online banking.

Member support

If you have any questions or concerns, please contact your local branch.

We appreciate your understanding of the need to complete the database integration to finalize our operational alignment with Casera CU and Carpathia CU.