Our database integration is complete!

Thank you to all of our members for your patience. If you were an Ideal Savings member, welcome to Hubert!

Happy savings!

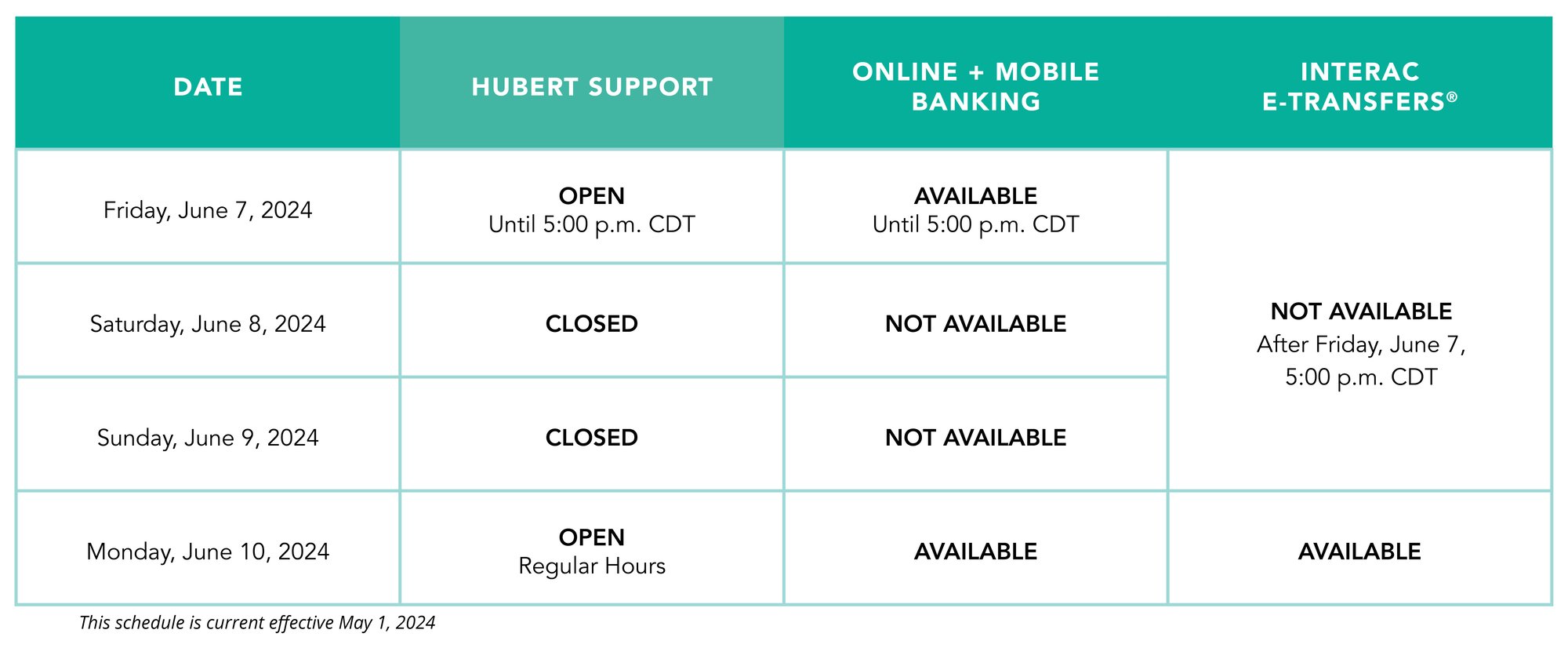

Online Banking Will be Unavailable June 7-10, 2024

We are completing our operational alignment between Casera Credit Union, Carpathia Credit Union, and Access Credit Union with a database integration June 7-10, 2024.

We’re working hard to minimize inconvenience to our members, however, there will be some impacts on members during this integration weekend.

Service Disruptions

How can you prepare for the integration weekend?

- Online banking will be unavailable. Complete any urgent online banking transactions before 5:00 p.m. CDT on Friday, June 7.

- Hubert Financial will be closed from Friday, June 7 at 5:00 p.m. until Monday morning at 8:30 a.m. Ensure you’ve completed all pertinent banking transactions with our representatives before 5:00 p.m. CDT on Friday, June 7.

If you have any questions or concerns, please contact us at 1-855-4HUBERT (1-855-448-2378).

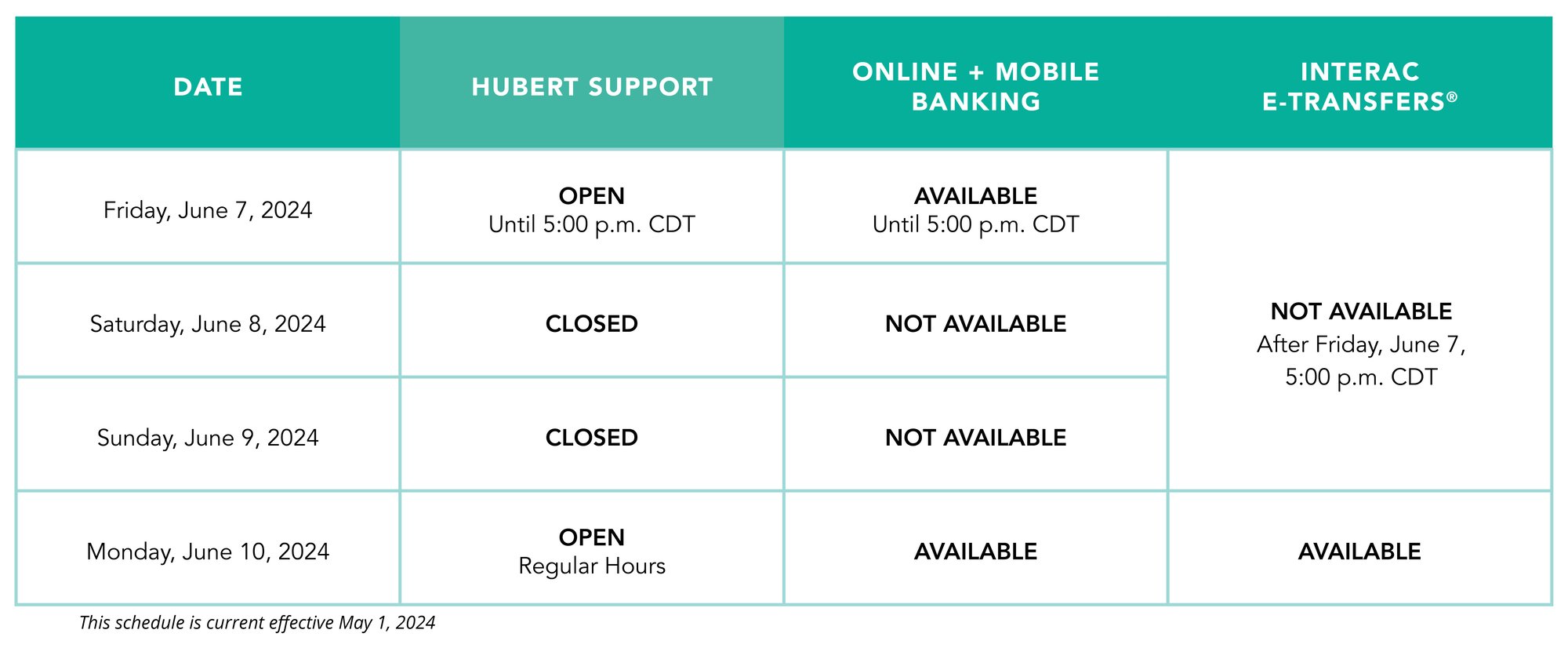

Service Disruptions

How can you prepare for the integration weekend?

- Online banking will be unavailable. Complete any urgent online banking transactions before 5:00 p.m. CDT on Friday, June 7.

- Hubert Financial will be closed from Friday, June 7 at 5:00 p.m. until Monday morning at 8:30 a.m. Ensure you’ve completed all pertinent banking transactions with our representatives before 5:00 p.m. CDT on Friday, June 7.

If you have any questions or concerns, please contact us at 1-855-4HUBERT (1-855-448-2378).