We have successfully aligned systems between Legacy Sunova and Access Credit Union.

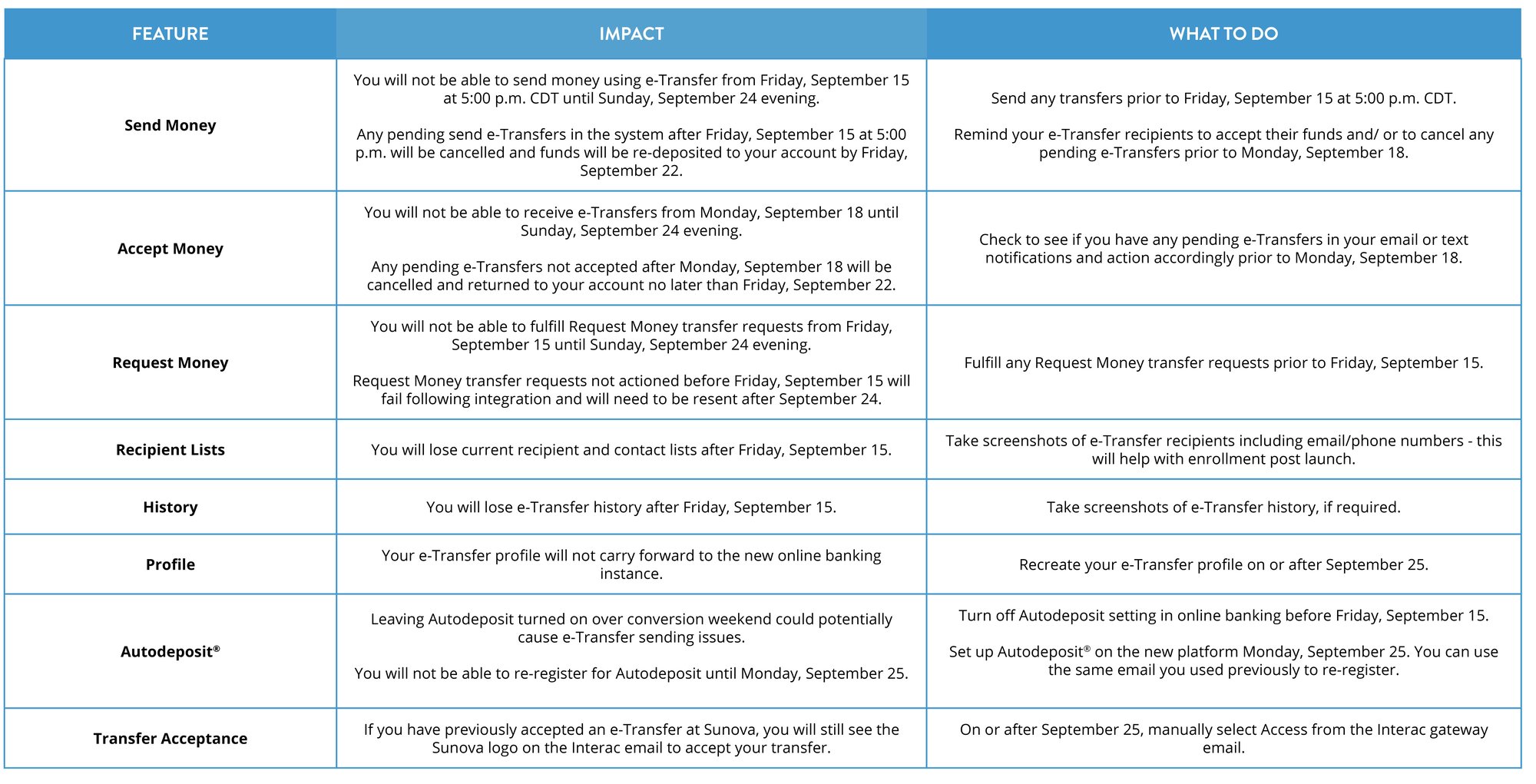

INTERAC e-Transfer®

INTERAC e-Transfer®

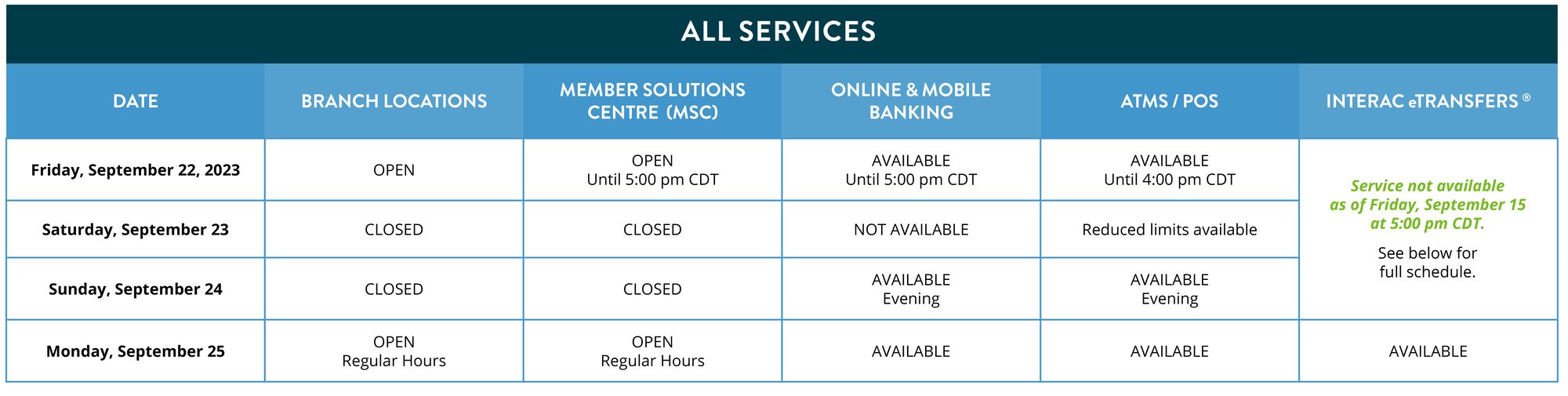

INTERAC e-Transfers® will be impacted from Friday, September 15, 2023.

Please review the outage schedule below to prepare for this service interruption:

Online Banking

Online Banking

Online and mobile banking will be unavailable effective 5:00 p.m. CDT on Friday, September 22, and will come back online in the evening of Sunday, September 24.

![]()

Please use accesscu.ca to access online banking going forward.

After integration weekend, Sunova members will sign into online banking from the accesscu.ca website.

Your 16-digit Sunova debit card is your Login ID number for first-time onboarding. If you do not have a debit card number, you will be mailed a unique 16-digit code for onboarding purposes. If you have not received your login ID number by September 20, please reach out to us directly.

| Alphanumeric: Can include: Upper case, lower case, numbers, and special characters (dash -, underscore _) |

| Maximum of 34 characters |

| Cannot use the debit card number |

| Cannot use an email address |

| Must be unique (does not already exist for another user) |

Note: If you already use online banking as an Access CU or AcceleRate member, you will continue to sign in as normal with those credentials and your Sunova accounts will be viewable on that login when service returns. At time of first login, you will be prompted to create a new username and password.

|

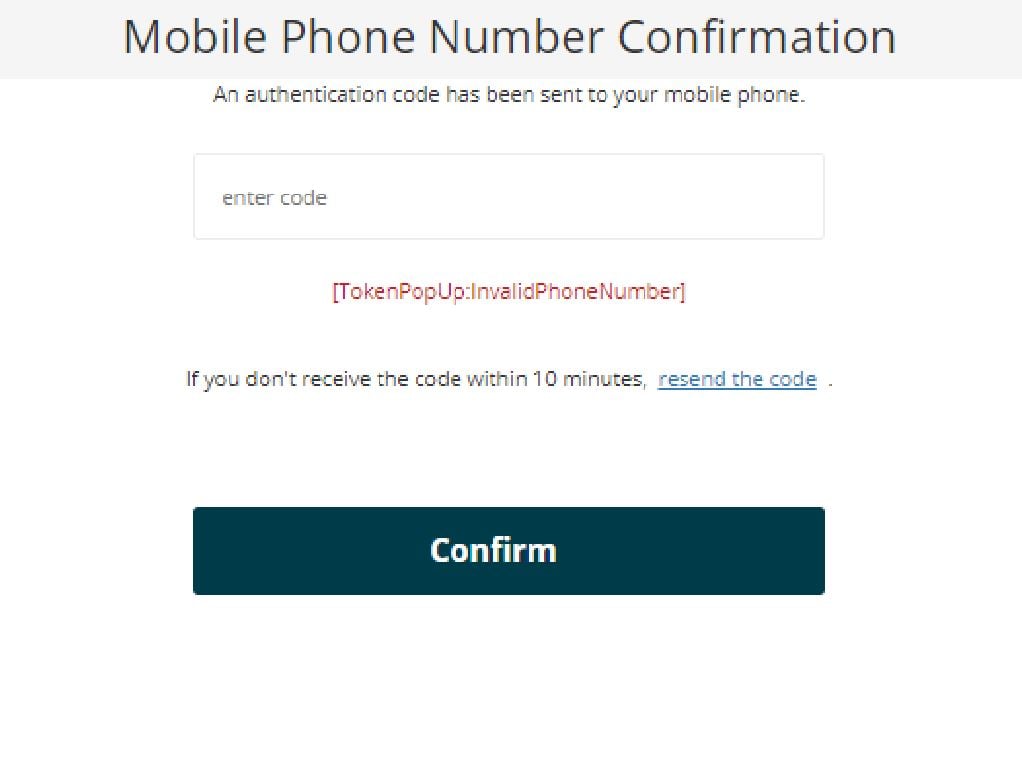

Select your area code in the first box, and then enter the rest of your phone number in the next box. If you add +1 XXX XXX XXXX in the cell box, you will get an invalid phone number error, and will not receive your One Time Passcode (OTP).

After September 25, please contact us if:

- You have changed your email or cell number recently

- You are having issues onboarding.

Please visit accesscu.ca/digital for tutorials, tips and tricks, and a full list of features and benefits.

Other Features

Other Features

NEW Features!

NEW Features!

-

Make principal loan payments (on select products)

-

Select a profile image and background image on the app for a more personalized experience.

-

Save transactions as favourites for ease of use

Mobile Banking

Mobile Banking

We are actively working with our partners to include features that were previously available with Sunova.

Are you a Business Member?

The new online and mobile banking service also offers several new features and security benefits, allowing you to make the most of your business online banking account:

- Online dual signature access for businesses with dual-signing authority

- Increased INTERAC e-Transfer® send limits

- Ability to consolidate accounts once your business is set up online

- Higher remote deposit limits when depositing cheques via mobile app

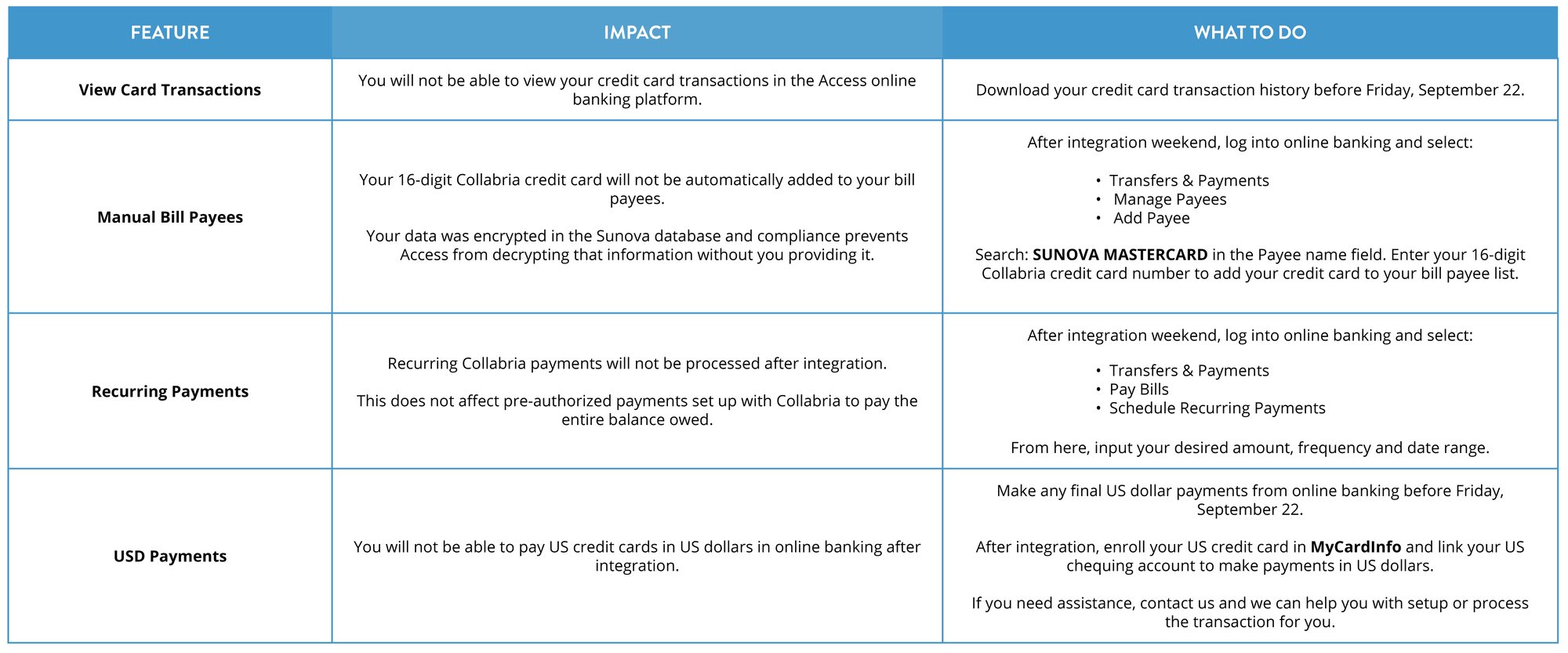

Collabria Credit Cards

Collabria Credit Cards

Your existing credit card will continue to work, however, it is advisable that you use MyCardInfo to manage your card as some features are not available on the Access mobile banking platform. MyCardInfo is external to online banking and the best place to view transactions, manage payments and billing, and view statements. To enroll, visit MyCardInfo and click the Enroll link.

Note: The account number is your 16-digit Collabria credit card number.

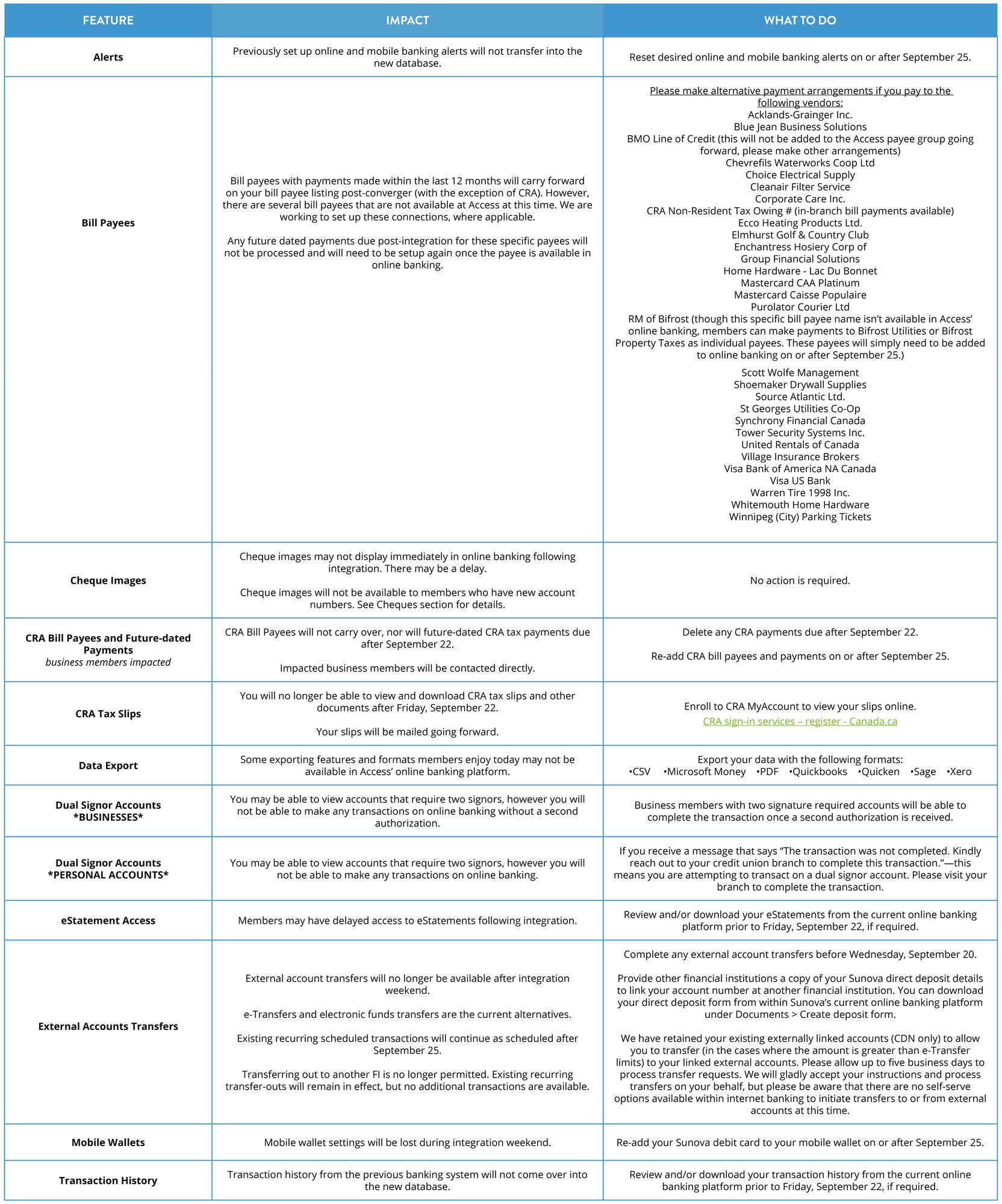

Below are the impacts to online banking:

Cheques

Cheques

Though existing Sunova cheques will continue to clear, there are some instances in which members may wish to order new cheques to ensure no interruption to service.

Some members who were previously with Oakbank CU prior to the Sunova merger currently write cheques written against an old account number. To ensure these members can view cheque images in online banking, members can order new cheques that correlate to the account numbers in our banking system after September 25.

We have identified accounts that have the same account number in the Sunova CU and the Access CU database. If your account is identified as one of these accounts, you will be issued a new unique account number.

Your cheques will continue to clear; however, you will not be able to view them in the transaction history in online banking as of September 25, 2023. The cheque images will continue to appear on your printed statement and electronic statement accessed via online banking.

You do not view your cheque images online. Simply ensure that you are using your correct account number the next time you order cheques. If you are unsure, our staff will assist you.

- Order online. Log in to your current online banking. Select Account Services from the left-hand menu > Select Order Personal Cheques or Order Business Cheques and fill out the Personal or Business Cheque Order Form and submit with the Order Cheques button.

- Visit your local branch.

- Contact our Member Solutions Centre at 1.800.264.2926.

Statements

Statements

Following our banking system integration, you will see one consolidated view of every account that you have a tax-owner or non-tax-owner role within the online and mobile banking platforms as well as on your statements. The information presented on your statement will be inclusive of all accounts in which you have an ownership role, including any joint accounts you may be a part of.

- You will continue to receive your statement on a month-end cycle.

- Members will see a change in banking statements; the way they look, when they are received, and the information that appears on them.

- You will have 7 years of historic e-statements loaded onto the Access platform.

Final statement schedule:

- September 1 – 22 (Last current statement)

- September 23 – 30 (Your new Access-branded statement)

Note: Any rate changes that occur during September may not appear on the second Access statement, but will be calculated as normal.

Statement delivery options:

- If you currently use online banking you will receive e-statements. If you require paper statements, please visit a Sunova branch.

- If you currently have all of your statements set to receive a printed statement and do not have access to online banking, your statement will continue to be mailed to your home every month.

- If you have dual membership (i.e. you are an Access and Sunova member, an AcceleRate and Sunova member, an Access and Hubert member, etc.) that receives any of your monthly statements via e-Statement, all of your account statements will be received via e-Statement only.

Though many of the statement features are already in place for legacy Sunova members, we encourage all members to read the following so you can better understand your banking statements.

How to Read Your New Statement

Here’s how to read your Access Credit Union statements:

Have a question about your statements?

If you have a question or concern, please reach out to your local branch or contact the Member Solutions Centre at 1.800.264.2926.

What will not change after the platform conversion?

- Account Nicknames named prior to conversion will carry the nickname forward into the new system.

- Existing ATM/Debit Cards will remain active and valid. PINs will remain the same.

- Automatic Transfers such as pre-authorized payment and direct deposits, will carry over to the new system. This includes bill payments and payroll deposits (excludes CRA Payments).

- Bill Payees set up pre-integration will remain.*

- Stop Payments put in place prior to conversion will remain after conversion weekend.

*Some limitations apply. See table above for details.